If digital retail is so great, then why does Apple have stores? Shipping a six-ounce phone is nothing compared to delivering a car, and yet these iconic stores. This, of course, is the true meaning of “omnichannel” retail – meeting your customer wherever they choose.

Digital native retailers, in fact, are advised to add physical stores, even if they’re selling only sneakers or eyeglasses. McKinsey advocates this as a way to gain cheaper traffic – ironic, considering the popular misconception that digital retail has lower costs.

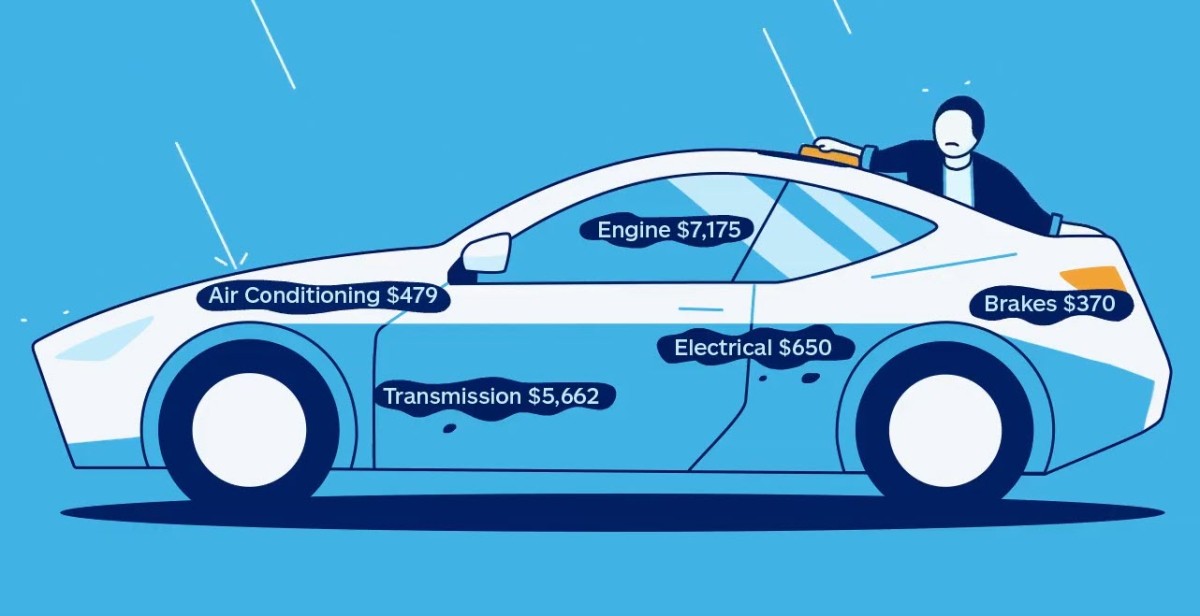

Brick and mortar car dealers have service departments which can keep them afloat in a recession. They also have an easier time selling F&I products. So, no surprise that online car dealer Driveway has lately opened a showroom, except … Driveway is the online brand of Lithia, a public dealer group with over 250 stores.

If a Driveway customer in Oregon wants a vehicle that’s in stock in Texas, it’s shipped to the Portland store and delivered to the customer.

That’s right, the online brand of the leading dealer group now has its own store – with no cars. This makes perfect sense to me. I bought my last car online, in the dealership. The salesperson ran the same configurator I would run at home, adding value with her knowledge of the product.

Omnichannel Auto Retail

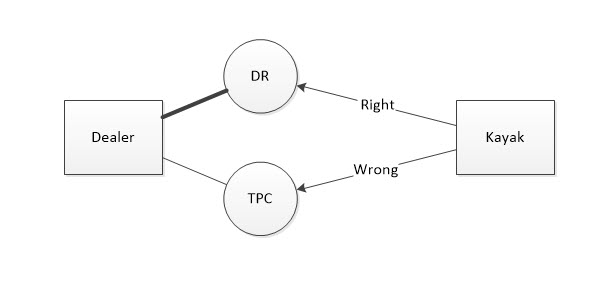

Here is a brief history of how we got here, with links to contemporaneous coverage on the blog. Schematically, the omnichannel evolution looked like this:

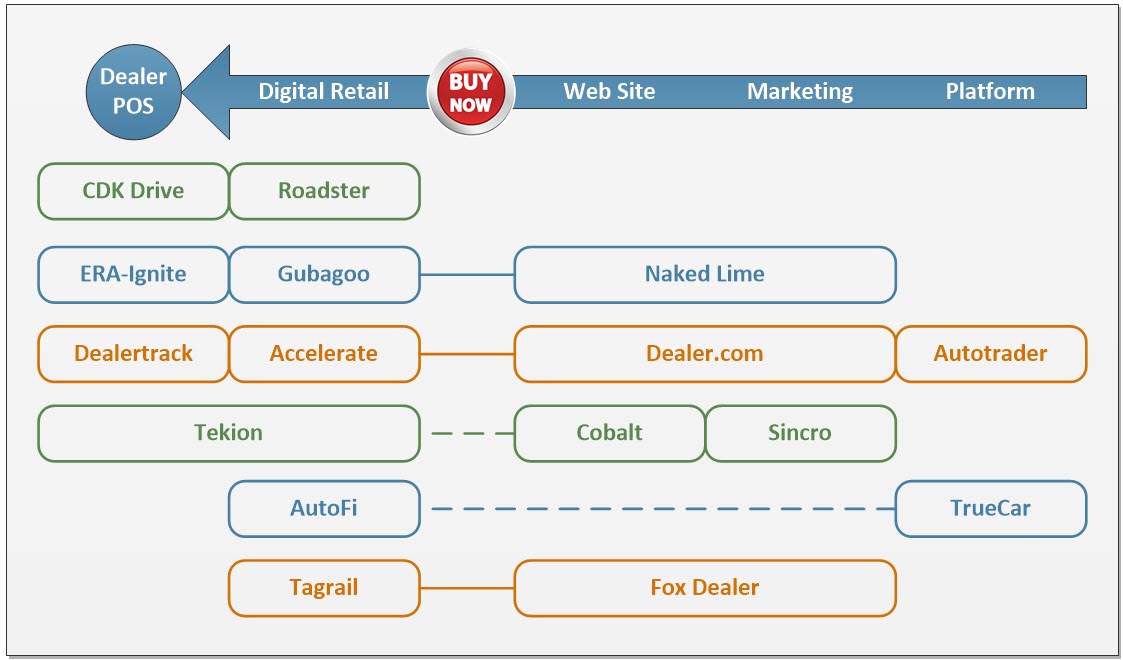

I started writing about digital retail way back in 2015, with a two-part post on Design Concepts for Online Car Buying. I didn’t manage to land a gig building one, but I got the next best thing. My job running e-commerce for Safe-Guard put me in touch with emerging leaders like Roadster and Accelerate.

These systems allow dealers to retrofit digital retail into their existing websites, while public groups Lithia, Asbury, and CarMax developed their own. I covered the market for digital retail software from a few different angles. See here, here, and here.

Dealers invested in digital retail, but they didn’t always get the desired results. Software vendors were the first to spot the disconnect between process and technology. Roadster started writing about omnichannel in 2018. Cox’s Mike Burgiss exhorted dealers to “sell the car, not the appointment.”

The true revenue performance of a retailer’s online channel can be understated by up to 100 percent, or even more if not accounting for the influence online has on offline.

Around this time, I was writing about a Best Buy model for auto retail. McKinsey linked the two concepts in this 2021 article. For me, their most important observation is that our metrics don’t always give proper credit to the online channel.

Digital Native Car Dealers

Digital natives Vroom and Carvana missed the memo about having a physical presence. Hell, even Amazon has retail stores. Lithia and CarMax are more like “digital immigrants.” Driveway going back to its roots and opening a physical store reminds me of “reverse ETL” from Data Engineering.

Data Engineers spend a lot of effort extracting, transforming, and loading (ETL) data for use in analytics. Then, we often find it useful to take the cleaned-up data and push it back into the transactional system whence it came.

Another analogy might be how elephants evolved from seagoing mammals and back to land again, or how computing power was centralized in the mainframe era, and now recentralized in cloud services … but “reverse omnichannel” makes a better title.